Storm clouds gather behind the logo of Boeing at the 2023 Paris Air Show. (Aaron Mehta/Breaking Defense)

WASHINGTON — Boeing is considering selling off a small defense subsidiary that makes surveillance equipment for the US military and intelligence community, Breaking Defense has learned.

Boeing has engaged financial advisers to seek out potential buyers for its Digital Receiver Technology Inc. business, as well as to gauge interest in unspecified defense programs under Boeing’s aftermarket business division, Bloomberg first reported on Tuesday, citing people familiar with the discussions.

A source with knowledge of the discussions told Breaking Defense that conversations about the DRT sale have been going on for about a year — long before the U.S. planemaker became embroiled in a reputational crisis after a door plug ripped off a Boeing 737 MAX airliner in mid-air in January.

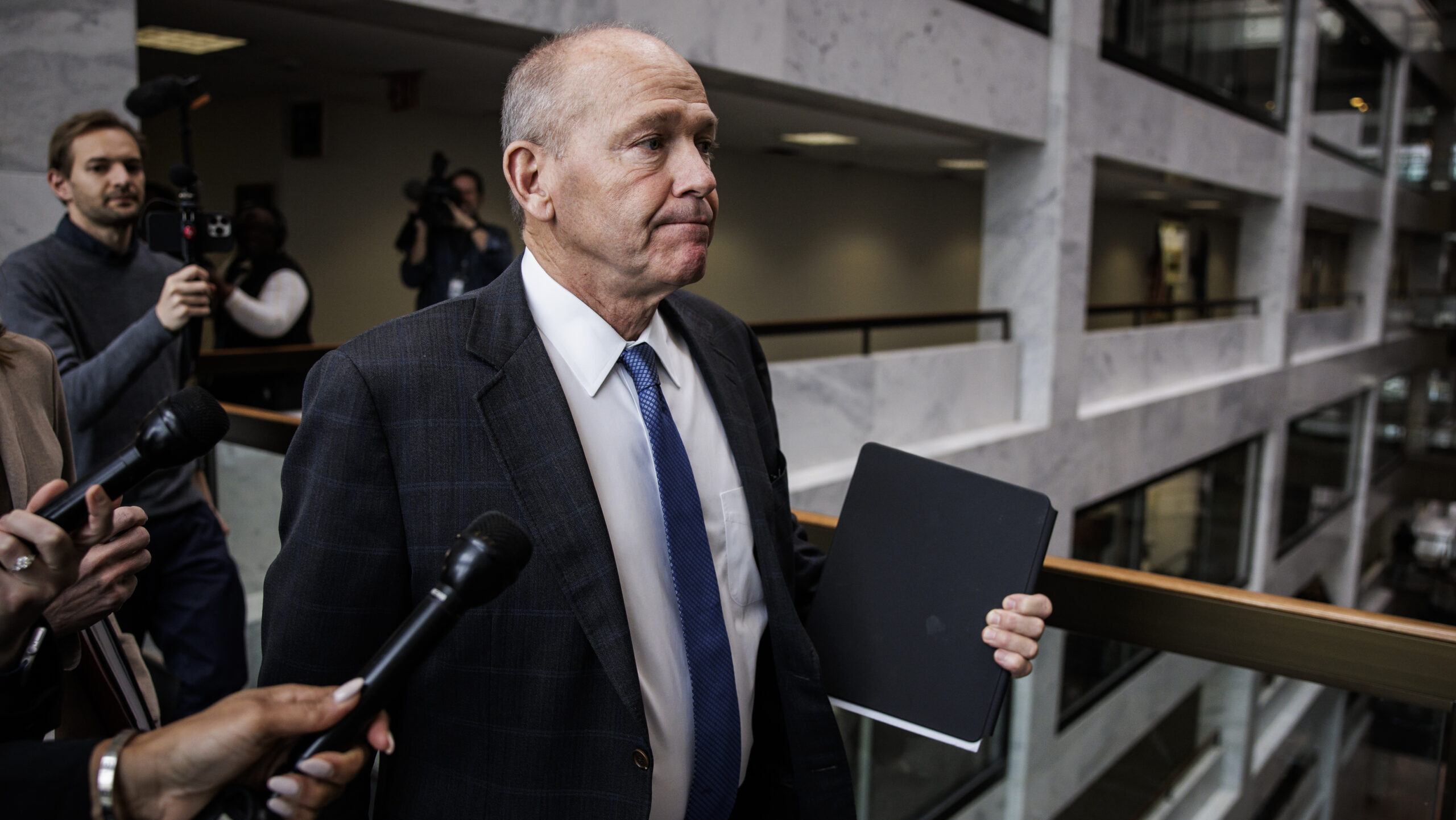

Boeing declined to comment on Tuesday. During a Bank of America conference earlier today, Chief Financial Officer Brian West said he wouldn’t speculate on whether the company would sell off portions of its defense business, but said the reported divestments were “pretty small to us, both economically and strategically.”

“We love our strategic position across our defense portfolio,” he said.

Boeing acquired Germantown, Md.-based DRT in 2008, when the aerospace giant was seeking to expand its presence in the intelligence sector. DRT, which sold for an undisclosed amount, specializes in the production of wireless receivers and transceivers.

Richard Aboulafia, an aerospace expert with AeroDynamic Advisories, said a sale of DRT is unlikely to have any material financial impact for Boeing, which has been struggling under the weight of $39 billion in debt and could face further financial headwinds as it considers re-acquiring Spirit AeroSystems, a Boeing spin off which makes large fuselage components for Boeing and Airbus commercial jets.

Selling DRT could be a routine disposal of a non-core business, while any potential sale of defense-related aftermarket work is likely to revolve around maintenance of obsolete aircraft that brings little value to the profitmaking Boeing Global Services division, Aboulafia said.

However, they could set the stage for a larger shakeup within Boeing’s defense business, he added.

“The bigger context is, why? Unless it’s the start of a bigger series of divestitures, which has been my suspicion for some time. These guys don’t want to do any actual work, they just want to break up the company,” he said, referring to Boeing’s executive leadership.

Boeing and Lockheed Martin conglomerate United Launch Alliance has been seeking new ownership for the past year, multiple media outlets have reported. The Wall Street Journal reported in December that Jeff Bezos-owned Blue Origin and private equity firm Cerberus have submitted bids to buy the rocket maker, which competes against SpaceX for national security launch contracts.

According to Bloomberg, Boeing has also considered selling off Argon ST — a subsidiary that makes sensors and communications systems — but has put that process on hold.

UPDATED 3/20/2024 at 10:13am ET with comments from Boeing’s chief financial officer.