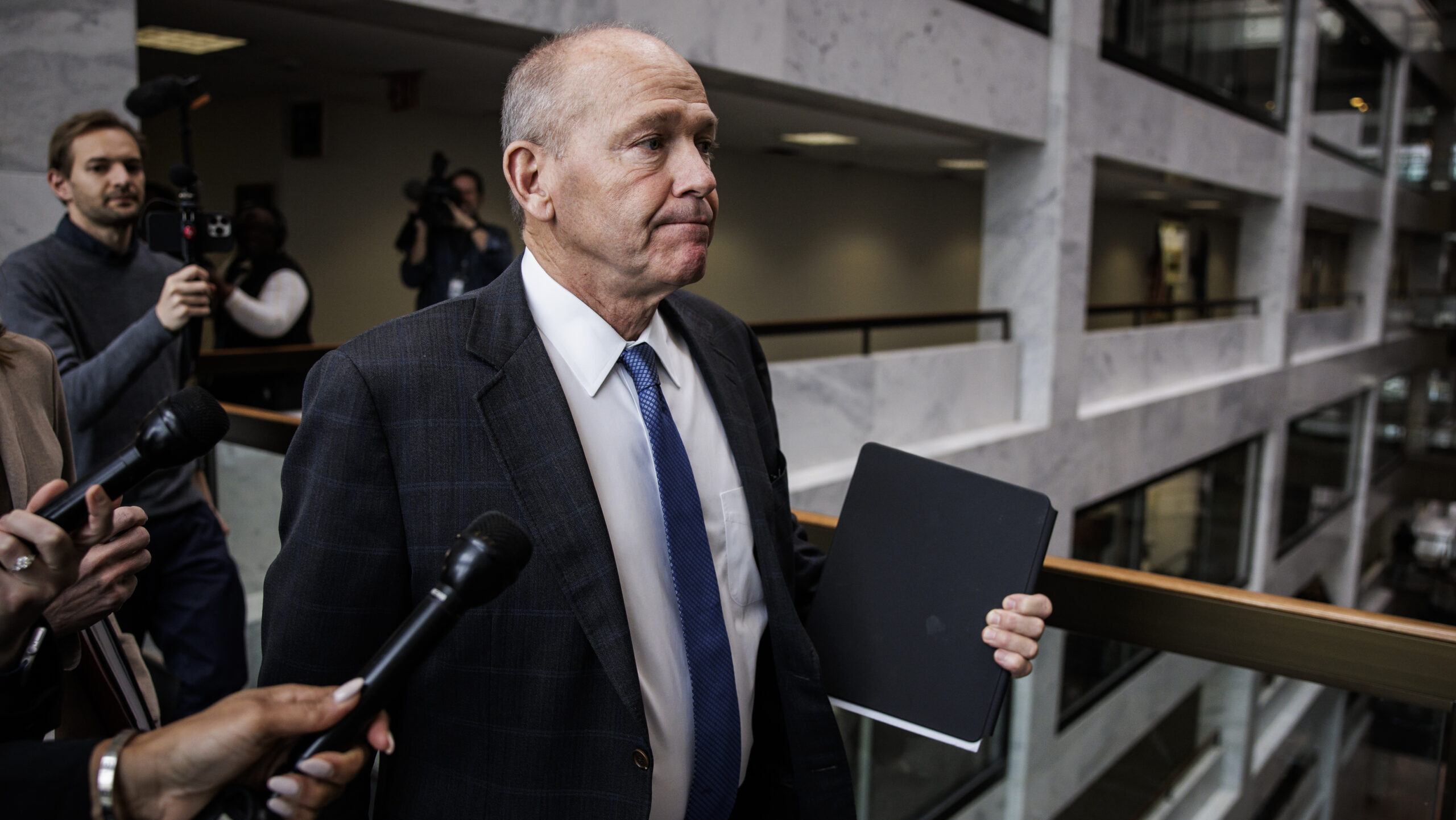

Air Force Gen. CQ Brown displayed a new image of the B-21 Raider during a keynote address at the Air & Space Forces Association Air, Space & Cyber conference on Tuesday, Sept, 12. (US Air Force photo.)

WASHINGTON — Northrop Grumman disclosed today that a new stealth bomber the company is building for the US Air Force is expected to lose over $1 billion in its early production stages, fulfilling previous warnings by executives that a loss of that magnitude could come to pass.

For several quarters, the defense contractor has disclosed in earnings reports that due to a fixed-price contract for the B-21 Raider’s low-rate initial production (LRIP) phase that was signed in 2015, a loss of up to $1.2 billion could be possible amid high inflation and workforce disruptions. That loss is now realized in a pre-tax charge of $1.56 billion, or $1.17 billion post taxes, according to the company’s 2023 year-end earnings report.

“While we’re disappointed that our assessment of conditions for the low-rate initial production portion of the B-21 program necessitated this charge in the quarter, we are confident in our ability to deliver on the company’s forward outlook, which remains unchanged,” said Northrop Grumman’s Chief Executive Officer Kathy Warden.

The B-21 charge helped drive a net loss of $535 million for the company in the fourth quarter of 2023, though the earnings release was not all bad news for investors. Northrop Grumman’s backlog climbed to a record $84.2 billion and company leadership expects free cash flow to increase at a “double digit rate for several more years,” according to Chief Financial Officer Dave Keffer.

After taking its first flight in November, the Raider program has been given the go-ahead by the Pentagon to begin its LRIP phase. According to Northrop Grumman, five LRIP options are on contract, with the program’s loss spread out among aircraft contained in each that will be produced over several years. The program’s engineering and manufacturing development (EMD) phase has a cost-plus structure and covers six test aircraft.

The Pentagon so far has provided $60 million to offset some inflationary impacts for the B-21 program. Warden said under a “tight budget environment,” the company has “lowered” expectations for further inflation relief, and though discussions are ongoing for more, “our focus is on executing the program and finding opportunities in the performance on the program.”

The company’s other major nuclear modernization effort, the LGM-35A Sentinel that will replace the Air Force’s Minuteman III ICBM fleet, recently suffered a “critical” cost breach that has prompted a review by the Office of the Secretary of Defense. Warden reiterated statements from Air Force officials that the cost growth is primarily driven by construction costs associated with silos and launch centers, adding that “near-term assumptions” of sales and profitability for Sentinel are not “materially impacted” by its issues.

As Northrop Grumman absorbs the losses associated with B-21, the aerospace giant is heeding lessons learned by other contractors about the pitfalls of fixed-price contracts. Since bidding on B-21 in 2015, “we certainly have changed our view on bidding of contracts where we did not have a mature design at the point of bid and yet we committed to fixed-price options into the future,” Warden said. “And we have, to my knowledge, not done that again.”

Northrop Grumman has “passed on high-profile programs” due to its apprehension around fixed-price contracts, according to Warden, and been more cautious in its bids. For example, Warden said Northrop Grumman submitted a bid on the Space Development Agency’s Tranche 2 tracking satellites for a price that the company thought was “fair and reasonable,” but the agency “decided not to further negotiate with us.” SDA ultimately tapped L3Harris, Lockheed Martin and Sierra Space for that effort, awarding each fixed-price contracts.

“These are things that are going to happen, and we are going to remain disciplined,” she said.