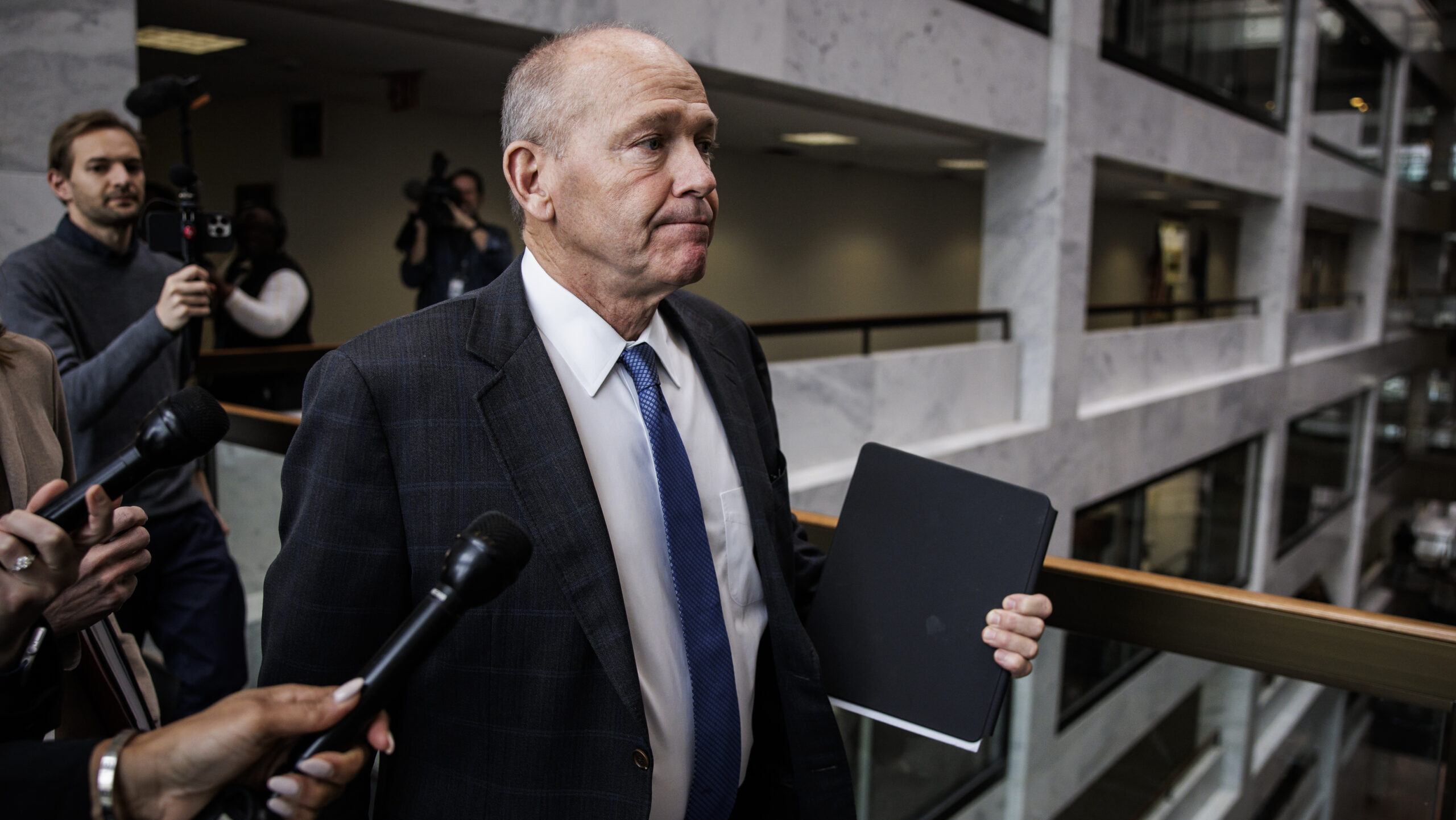

The US has supplied Ukraine with thousands of Javelin antitank weapon systems with plans in motion to sell 600 units to the UK (Lockheed Martin)

WASHINGTON — Rocket engine maker Ursa Major is the latest company to join the increasingly crowded race to fill the Pentagon’s skyrocketing demand for solid rocket motors (SRMs) — as the Defense Department stares down a gaping hole in missile inventories in the wake of the war in Ukraine.

Describing the solid rocket motor market as “plagued by a broken supply chain and an overextended industrial base,” the Colorado startup today announced its plans to use its 3D printing techniques developed for liquid rocket engines to speed production of solid-fuel propulsion systems. Ursa Major has received several contracts from the Air Force Research Laboratory for its work on a new rocket engine for heavy space launch vehicles, as well as a hypersonic engine.

“Traditional SRM providers rely on production lines that are difficult to re-tool, expensive to ramp up, and dependent on a significant workforce to operate,” the company said in a press release touting its “new approach” to manufacturing, dubbed Lynx.

“Ursa Major is offering a new way to scale production of SRMs,” Ursa Major CEO Joe Laurienti said in the press release. “Lynx meets the defense industry’s need for a faster, cheaper, scalable, and flexible SRM production process that results in better-performing solid rocket motors.”

Besides the use of 3D printing, also known as additive manufacturing, the company is revamping the traditional approach to propellant manufacturing that saw specific fuel mixes for specific types of rocket motors.

“Additionally, the motor design is intended to allow for common propellants used across multiple applications. This approach could address supply chain challenges often associated with developing bespoke propellants for each individual motor application and could enable increased collaboration with other industry partners,” the release explained.

DoD officials and outside experts have been wringing their hands for the past year over the state of the US supply chain for solid rocket motor technology, as stocks of munitions and missile systems reliant on SRMs — such as the Army’s Javelin shoulder-mounted anti-tank weapon, Guided Multiple Launch Rocket System (GMLRS), and Stinger missiles — have been depleted by sales to Kiev.

According to a January study by the Center for Strategic and International Studies, it could take five years to replenish Javelin stocks under a “surge rate” of production by partners Lockheed Martin and RTX (formerly Raytheon), and as many as 18 years for Stinger stocks at the “recent rate” of production by RTX.

Until very recently, the two main providers of SRMs in the United States have been Northrop Grumman and Aerojet Rocketdyne, now owned by L3Harris. That market duopoly is rapidly becoming a thing of the past.

In June, defense firm Anduril announced its acquisition of the small solid rocket motor firm Adranos, a purchase aimed at scaling up Adranos’s production capacity to compete with larger primes as a supplier for missiles, hypersonics and other systems. Anduril founder Palmer Luckey told Breaking Defense at the time that the intent is to put the company’s skill in use of artificial intelligence tools and automation to work on producing SRMs “all the way from Javelin-class all the way up to intermediate range missiles.”

In September, the Pentagon announced that it awarded $64 million to a New Mexico startup X-Bow Systems, which DoD said in a release would “expand manufacturing capacity and reduce the production cost of solid rocket motors used in hypersonic weapons.” In particular, the contract is designed to bring on X-Bow as a new supplier for the Navy’s Conventional Prompt Strike program as well as the Army’s Long-Range Hypersonic Weapon, which share a common hypersonic glide body.

On Nov. 16, X-Bow announced a new round of funding that included investment by Lockheed Martin Ventures, the defense behemoth’s investment arm, as well as private capital firms. Indeed, Lockheed Martin has embarked on a “campaign” to find new suppliers of SRM technologies.